Confused about health plan options? Here’s what you need to know

Students have until Oct. 2, 2020 to either sign up for the health plan or opt-out, but how much do students know about this service?

Algonquin offers a private health-care plan to full-time domestic students as part of the cost of their tuition. In Ontario, public health insurance (OHIP) partially covers a range of services from doctors’ visits to birth control. But there are certain restrictions — OHIP won’t cover everything, and that’s where private insurance comes in handy.

Availability is one thing, but awareness is another.

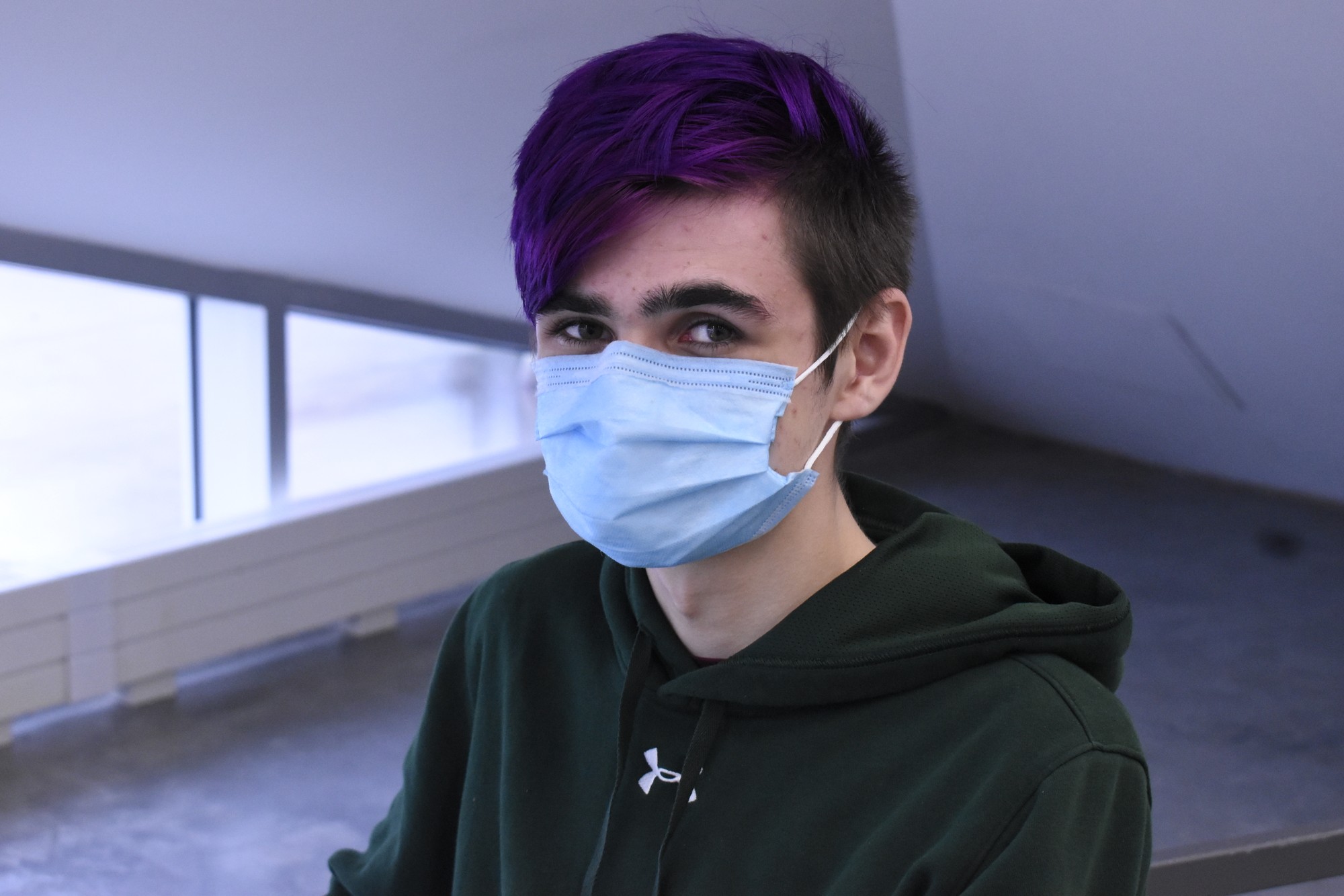

William Dean, a child and youth care student in his second year who has never used the college’s health plan, tries to explain what he remembers about the insurance policy from his first year.

Madeleine Thompson, a second-year tourism and travel student, says the health plan is just “another college cash grab.” She’s frustrated with the program’s accessibility.

“In my experience, nothing was ever explained thoroughly,” said Thompson. “I’ve had to contact them multiple times for clarification and so far I’ve found it useless and had to pay for everything because it takes so long to find out what’s covered and what’s not.”

To alleviate some of the confusion, the Times has broken down the health plan, how to access it and the various benefits included with different plans.

There are two basic options.

The Flex plan is the default health care option, which provides benefits to the student. This option is ideal for students who are single without any dependents. The family plan provides benefits to both students and their families. This option is great for students who want to add one or more family members to their plan, including spouses and children.

Depending on what you need, there are four plans to choose from.

On the WeSpeak website, click the white box at the bottom of the text boxes and type “Algonquin College”, and it will redirect you to a page that looks like this.

Students have until October 2 to click the “choose your plan” box. If they do, they can choose from one of four plans.

The balanced plan is the default benefit students are afforded if they don’t choose themselves. It has $3,000 maximum annual coverage for prescription drugs and 80 per cent coverage for most prescription drugs, $500 maximum annual coverage for dental, and 100 per cent coverage to a maximum of $50 for a general eye exam and $100 for prescribed contact lenses and frames.

The enhanced drug plan focuses on pharmaceutical care with $5,000 maximum drug coverage per year and 90 per cent coverage for most drugs. Dental coverage is reduced to a $300 annual maximum, while vision coverage remains identical to the balanced plan.

The dental focused plan allows $2,000 annual maximum drug coverage and 70 per cent coverage for most drugs, with a rise to $750 maximum basic dental coverage, as well as 100 per cent coverage of minor restorative work and 80 per cent coverage of extractions and oral surgery. Again, this plan offers the same vision coverage as the balanced plan.

The vision focused plan offers $2,000 maximum drug coverage annually and 70 per cent coverage for most drugs, with $300 maximum dental coverage per year. This plan offers 100 per cent coverage to a maximum of $50 for a general eye exam and $150 for prescribed contact lenses and frames every 24 consecutive months.

How can a student make a claim online?

From the WeSpeak website, click the box that says “eProfile for online claims submission”. This will redirect students to a page that will ask them to create a profile if they are first-time users. They will be asked to present the information provided to them via their health plan card. If you never received a health plan card via email, don’t panic. The information for all students is similar: the group number is 513970, the provider is ClaimSecure, and your student ID is “A” followed by your student number. After entering this information, students will be asked to login and fill out a claims form to submit online.

How can students opt-out?

Students can opt-out of the health plan by October 2, however, full-time students are not eligible for a refund of fees even if they’ve never used the health plan, and all other students will need to provide proof of an existing health insurance provider. Students can opt-out by clicking the box that says “opt-out” on the main page and following the instructions.

For students like Dean, more communication on the administration’s part is key.

“I’ve used the clinics before to get a concussion checked,” said Dean. “Now because of this interview maybe I’ll do some more research to see what’s covered. I feel like most people don’t even know that they’re paying for it.”

In a Zoom meeting with journalism students last week, Student’s Association president Emily Ferguson commented on the situation, revealing the high volume of inquiries the SA has been receiving regarding the health plan.

“We’re getting a lot of questions about the health plan,” says Ferguson. She further explained that frontline service associate Monica Saud handles most of the questions concerning the insurance policy.

The board of directors will be reviewing the health plan in “the next month or so,” according to Ferguson.

For more information about the health plan, visit the Student’s Association website, and to sign up for the health plan, visit wespeakstudent.com.