Here’s where Algonquin College students can save a buck

For many students, affordability is the top priority when making purchases. With the increasing cost of living, it has become more challenging to balance budgets and meet essential needs.

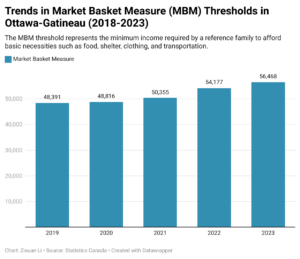

From 2018 to 2023, the cost of living in the Ottawa-Gatineau area rose by 16.7 per cent, according to Statistics Canada’s Market Basket Measure, which reflects the basic living costs for a family of four.

As the cost of living rises, affordability has declined, leaving students struggling more with their finances. Algonquin College students are feeling the impact on their budgets more than ever.

“Grocery prices are reaching massive heights. The bus is also getting a little expensive. Many people like me have to pay hundreds per month just to come back and forth commuting to college,” said Annalee De Silva, a part-time academic upgrading student.

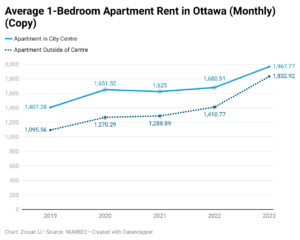

From grocery prices to rent, daily expenses are mounting, and many students are seeking ways to manage costs while focusing on their studies.

Silva said she noticed many young people today like living with their parents to save on rent.

Dalia Sambo, a Level 1 information resources management student, used to drive to school since she lives outside of Ottawa. However, due to high gas prices, she has started taking the bus instead of driving to save money. “It’s way more expensive now,” she said of gas prices.

For some students, even small luxuries have become a challenge.

“Whenever I go (to a restaurant or a café) with my friends, I always try not to order too many things because it will cost me more,” said Jeel Patel, a Level 1 environmental management and assessment student. “I have to think twice before buying something.”

For students, every dollar saved is crucial as they navigate the pressures of rising living costs. Fortunately, students can also use their AC Cards to get things at reduced prices.

Here’s where Algonquin College students can save a buck:

1. Grocery Savings

- Metro: 10 per cent off on Tuesday at Metro Beechwood Avenue and Metro Lincoln Heights, and seven days a week at Metro Rideau.

- Bulk Barn: 15 per cent off on Wednesdays for bulk purchases.

- Loblaws: 10 per cent off on Tuesdays.

- Food Basics: 10 per cent off on Tuesdays.

Tip: you can plan meals around current sale items and maximize grocery discounts by using Flipp.

2. Fun and entertainment

- The ByTowne (cinema) : Get $4 off every ticket and a free movie during the month of your birthday with student membership ($7.30)

- Spotify, Apple Music and YouTube Premium: Most streaming services offer special student rates for music and video, with discounts on monthly fees.

3. Shopping

- Student Price Card: For $11.99/year (or free with CIBC banking), students gain access to discounts up to 30 per cent at over 450 brands including Foot Locker, Apple, Adidas and UGG.

- ISIC Canada Card: Accepted in over 100 countries, this international student ID offers savings for students travelling abroad or around Canada.

- Student Beans and UNiDAYS: With a student ID, students unlock discounts from favourite brands in fashion, tech and more.

Discounts are good, but sometimes they can be dangerous. With Black Friday approaching on Nov. 29, many students are eager to take advantage of the biggest sale of the year.

Kyle Jorgensen-Lane, manager of Financial Aid and Student Awards at Algonquin College, reminds students to be prepared and mindful when shopping. “Don’t let sales drive what you buy,” he said.

Many stores and sales displays are specifically designed to appeal to human psychology, encouraging shoppers to make impulsive purchases. To avoid falling into this trap, students should be strict with themselves and stick to their pre-planned list.

“Ask yourself, ‘Why didn’t you think of it before?’ Probably it is because you don’t actually need it,” Jorgensen-Lane said.